Residential Market Commentary - March limps away

- Be the expert

- Apr 6, 2020

- First National Financial LP

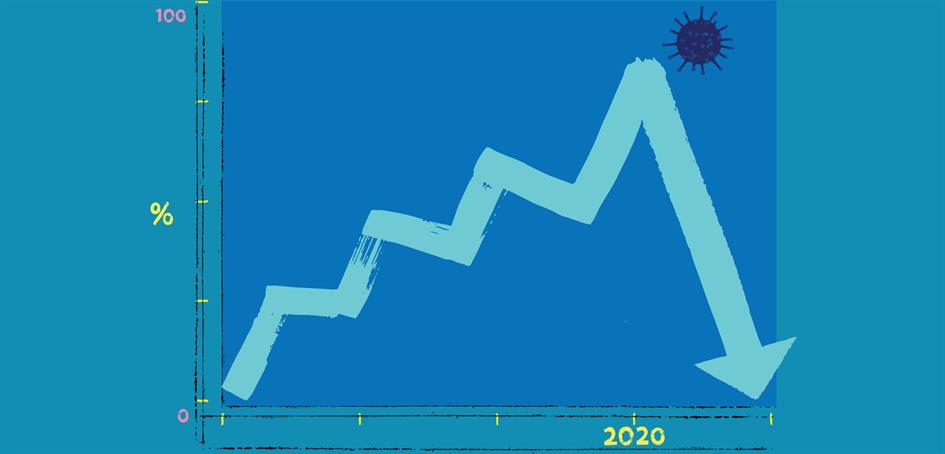

As the old saying goes, March comes in like a lion and goes out like a lamb. For Canada’s housing market, that is all too true this year. And the country’s two biggest markets make it abundantly clear.

The Canadian Real Estate Association reported strong year-over-year sales gains of 26% coming out of February. The Toronto Region Real Estate Board clocked-in with a 49% y/y increase for the first 14 days of March. But then COVID-9 entrenched itself as a bitter reality and things slumped.

Government imposed shutdowns and the implementation of social distancing have pretty much ended open houses and any face-to-face meetings with clients for both realtors and mortgage brokers. Real estate boards across the country have banned such interactions or are strongly recommending against them.

The Toronto-area market plunged in the second half of March, with sales falling to 16% below year ago levels. The month ended with a 12% gain over March of 2019. By comparison, February ended with a 44% increase over a year ago. A rough calculation by one of the big banks puts March activity at 23% below February.

The country’s other hot market, Vancouver, experienced a similar second half collapse in March, but came out of the month with a 46% increase in sales activity. That number is tempered, though, by a particularly weak March, last year.

Market watchers expect a continuing slowdown as the COVID-19 outbreak worsens and anti-virus measures intensify. They caution that property values will likely come under increasing downward pressure and that extremely light activity will make the market vulnerable to erratic price moves.

Related Articles

- Residential Market Commentary - Rate cut expectations

- Residential Market Commentary - Economy continues to grow

- Residential Market Commentary - Trump and Canada’s economy

- Residential Market Commentary - Big cut by BoC

- Looking forward: is Canada’s housing market poised for a rebound?

- Bank of Canada’s 7th decision of 2024 brings its benchmark interest rate to 3.75%